The Internal Rate of Return (IRR) - a fundamental concept in finance and investment analysis. If you're a Google Sheets user, you're likely aware of the built-in IRR formula, but do you know how to harness its full potential? In this article, we'll explore five ways to use the IRR formula in Google Sheets, helping you make more informed investment decisions and streamline your financial analysis.

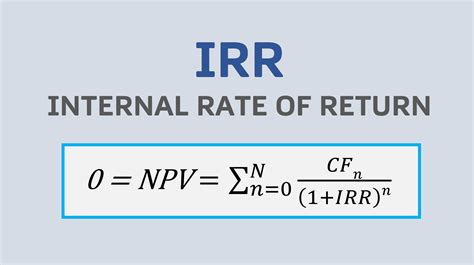

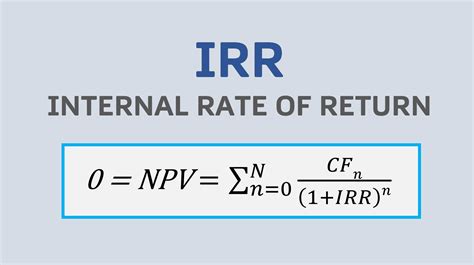

What is the IRR formula?

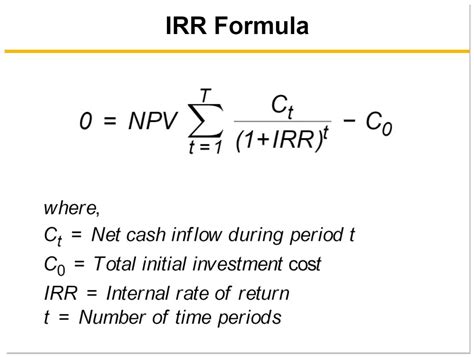

Before we dive into the five ways to use the IRR formula, let's quickly review what it is. The IRR formula calculates the internal rate of return for a series of cash flows, taking into account the initial investment, periodic cash inflows, and the rate at which the investment grows. The IRR is a crucial metric for evaluating investment opportunities, as it helps investors determine whether a project or investment is likely to generate returns that exceed its costs.

1. Evaluating Investment Opportunities

One of the most common uses of the IRR formula in Google Sheets is to evaluate investment opportunities. Suppose you're considering investing in a new project that requires an initial investment of $100,000 and is expected to generate the following cash flows over the next five years:

| Year | Cash Flow |

|---|---|

| 0 | -$100,000 |

| 1 | $20,000 |

| 2 | $30,000 |

| 3 | $40,000 |

| 4 | $50,000 |

| 5 | $60,000 |

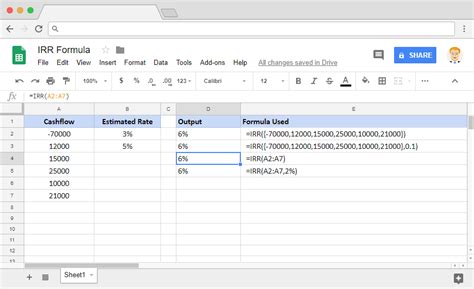

To calculate the IRR, you can use the IRR formula in Google Sheets:

=IRR(A1:A6)

Assuming the cash flows are in cells A1:A6, the IRR formula will return the internal rate of return for the investment. In this case, the IRR is approximately 12.4%. This means that the investment is expected to generate returns of 12.4% per year, which can help you decide whether the investment is worthwhile.

Image:

2. Comparing Investment Options

Another way to use the IRR formula in Google Sheets is to compare different investment options. Suppose you're considering two investment opportunities, each with its own set of cash flows. You can use the IRR formula to calculate the internal rate of return for each investment and then compare the results.

| Investment A | Cash Flow |

|---|---|

| 0 | -$50,000 |

| 1 | $10,000 |

| 2 | $20,000 |

| 3 | $30,000 |

| 4 | $40,000 |

| 5 | $50,000 |

| Investment B | Cash Flow |

|---|---|

| 0 | -$75,000 |

| 1 | $15,000 |

| 2 | $30,000 |

| 3 | $45,000 |

| 4 | $60,000 |

| 5 | $75,000 |

Using the IRR formula, you can calculate the internal rate of return for each investment:

=IRR(A1:A6) for Investment A

=IRR(B1:B6) for Investment B

The results show that Investment A has an IRR of approximately 10.2%, while Investment B has an IRR of approximately 13.5%. Based on this analysis, you may decide to invest in Investment B, as it appears to offer a higher return.

Image:

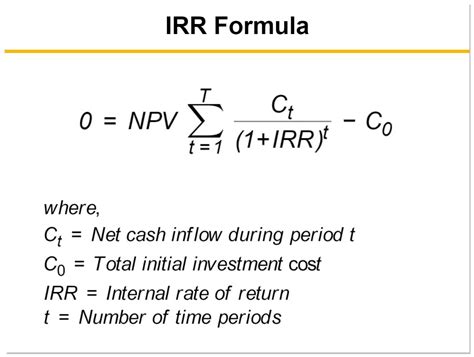

3. Sensitivity Analysis

The IRR formula can also be used to perform sensitivity analysis, which involves analyzing how changes in assumptions affect the outcome of an investment. Suppose you're evaluating an investment opportunity and want to know how changes in the initial investment or cash flows affect the IRR.

Using the IRR formula, you can create a table that shows the IRR for different scenarios:

| Initial Investment | Cash Flow | IRR |

|---|---|---|

| $100,000 | $20,000 | 12.4% |

| $120,000 | $20,000 | 11.6% |

| $100,000 | $25,000 | 14.2% |

By analyzing the table, you can see how changes in the initial investment and cash flows affect the IRR. This can help you make more informed decisions about the investment and identify potential risks.

Image:

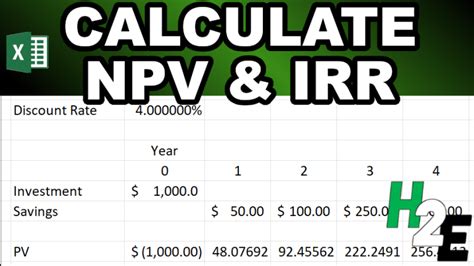

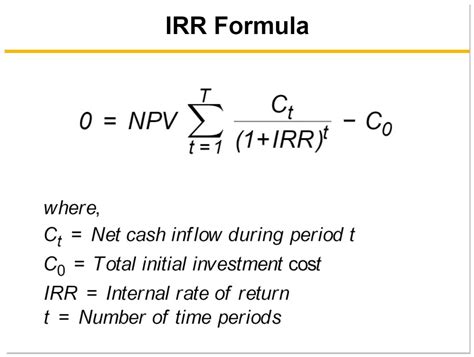

4. Calculating Net Present Value

The IRR formula can also be used to calculate the net present value (NPV) of an investment. The NPV is the present value of the cash flows minus the initial investment. To calculate the NPV, you can use the following formula:

=NPV(IRR(A1:A6),A1:A6)

This formula calculates the NPV using the IRR as the discount rate. The result shows the present value of the cash flows minus the initial investment.

Image:

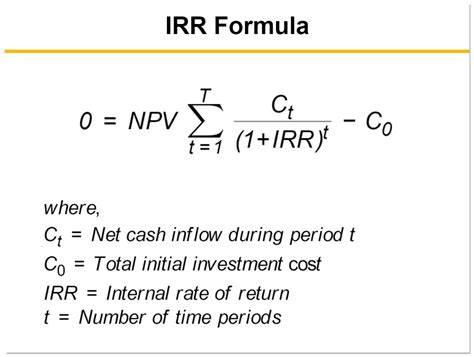

5. Creating a Template

Finally, you can use the IRR formula to create a template for evaluating investment opportunities. By creating a template, you can quickly and easily evaluate different investments and compare the results.

To create a template, you can set up a table with the following columns:

| Year | Cash Flow |

|---|---|

| 0 | |

| 1 | |

| 2 | |

| 3 | |

| 4 | |

| 5 |

You can then use the IRR formula to calculate the internal rate of return for the investment:

=IRR(A1:A6)

By creating a template, you can save time and effort when evaluating investment opportunities and make more informed decisions.

Image:

Gallery of IRR Formula Examples

IRR Formula Examples

Conclusion

In this article, we've explored five ways to use the IRR formula in Google Sheets, from evaluating investment opportunities to creating a template. By mastering the IRR formula, you can make more informed decisions about investments and improve your financial analysis skills. Remember to use the IRR formula in conjunction with other financial metrics, such as NPV and payback period, to get a comprehensive view of an investment's potential. Happy calculating!

Take Action!

- Try using the IRR formula in Google Sheets to evaluate an investment opportunity.

- Create a template for evaluating investments using the IRR formula.

- Share your experiences with the IRR formula in the comments below.

- If you have any questions or need help with the IRR formula, feel free to ask!