Intro

Secure real estate investments with a comprehensive Private Placement Memorandum (PPM) template. Learn how to craft a detailed, SEC-compliant document that attracts investors and protects your business. Get expert guidance on structuring your PPM to mitigate risk, ensure regulatory compliance, and successfully fund your real estate projects.

Private placement memorandums (PPMs) are essential documents for real estate investment offerings, providing potential investors with the necessary information to make informed decisions about investing in a project. A well-structured PPM can help build trust and credibility with investors, while also protecting the issuer from potential liabilities.

The Importance of a Private Placement Memorandum

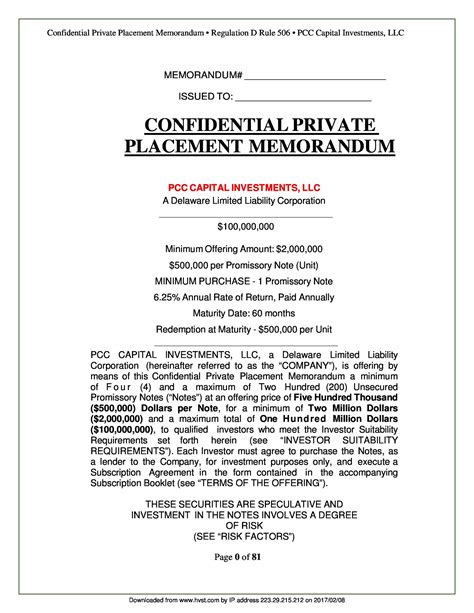

A PPM is a confidential document that outlines the terms and conditions of a private placement offering, including the investment structure, risk factors, and potential returns. It is typically used for offerings that are exempt from registration with the Securities and Exchange Commission (SEC) under Regulation D, Rule 506(b) or Rule 506(c).

Investors rely heavily on the information presented in a PPM to evaluate the investment opportunity and make informed decisions about investing. A comprehensive PPM can help investors understand the project's goals, risks, and potential returns, as well as the issuer's track record and management team.

Key Components of a Private Placement Memorandum

A typical PPM for real estate investments should include the following key components:

Executive Summary

The executive summary provides an overview of the investment opportunity, including the project's objectives, target market, and potential returns.

Investment Structure

This section outlines the investment structure, including the type of investment (e.g., equity, debt), the minimum investment amount, and the expected hold period.

Risk Factors

This section discusses the potential risks associated with the investment, including market risks, regulatory risks, and operational risks.

Use of Proceeds

This section explains how the proceeds from the offering will be used, including the allocation of funds for project development, acquisition, and other expenses.

Management Team

This section provides information about the issuer's management team, including their experience, track record, and qualifications.

Financial Projections

This section presents financial projections for the project, including projected income statements, balance sheets, and cash flow statements.

Regulatory Compliance

This section discusses the issuer's compliance with relevant securities laws and regulations, including the SEC's rules and regulations.

Creating a Private Placement Memorandum Template

To create a PPM template for real estate investments, issuers can follow these steps:

- Define the investment opportunity: Clearly outline the project's objectives, target market, and potential returns.

- Conduct market research: Gather data on the target market, including demographic information, market trends, and competition.

- Develop a financial model: Create a comprehensive financial model that outlines projected income statements, balance sheets, and cash flow statements.

- Identify risk factors: Discuss potential risks associated with the investment, including market risks, regulatory risks, and operational risks.

- Outline the use of proceeds: Explain how the proceeds from the offering will be used, including the allocation of funds for project development, acquisition, and other expenses.

- Highlight the management team: Provide information about the issuer's management team, including their experience, track record, and qualifications.

- Ensure regulatory compliance: Discuss the issuer's compliance with relevant securities laws and regulations, including the SEC's rules and regulations.

Real Estate Investment Image Gallery

By following these steps and including the necessary components, issuers can create a comprehensive PPM template for real estate investments that provides potential investors with the information they need to make informed decisions.

FAQs

Q: What is a private placement memorandum? A: A private placement memorandum (PPM) is a confidential document that outlines the terms and conditions of a private placement offering, including the investment structure, risk factors, and potential returns.

Q: Why is a PPM important for real estate investments? A: A PPM is essential for real estate investments as it provides potential investors with the necessary information to make informed decisions about investing in a project.

Q: What are the key components of a PPM for real estate investments? A: The key components of a PPM for real estate investments include the executive summary, investment structure, risk factors, use of proceeds, management team, financial projections, and regulatory compliance.

Q: How do I create a PPM template for real estate investments? A: To create a PPM template for real estate investments, issuers can follow the steps outlined above, including defining the investment opportunity, conducting market research, developing a financial model, identifying risk factors, outlining the use of proceeds, highlighting the management team, and ensuring regulatory compliance.

Q: What is the purpose of a PPM in real estate investments? A: The purpose of a PPM in real estate investments is to provide potential investors with the necessary information to make informed decisions about investing in a project, while also protecting the issuer from potential liabilities.

We hope this article has provided you with a comprehensive understanding of private placement memorandums for real estate investments. If you have any further questions or would like to discuss this topic in more detail, please don't hesitate to contact us.