Investing in the stock market can be a daunting task, especially for those who are new to the world of finance. With so many options available, it can be difficult to decide which fund to invest in. One popular option is the American Balanced Fund, a mutual fund that aims to provide a balanced portfolio of stocks and bonds. But what makes this fund so special? Here are 5 key facts about the American Balanced Fund that you should know:

What is the American Balanced Fund?

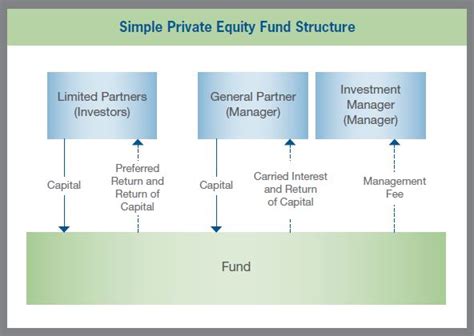

The American Balanced Fund is a mutual fund that invests in a balanced portfolio of stocks and bonds. The fund's primary objective is to provide long-term growth of capital and income, while also preserving capital. The fund is managed by American Funds, a well-established investment management company that has been in business for over 90 years.

History of the American Balanced Fund

The American Balanced Fund was first launched in 1975, making it one of the oldest balanced funds in the market. Since its inception, the fund has provided investors with a stable source of income and capital growth. Over the years, the fund has undergone several changes, including updates to its investment strategy and management team.

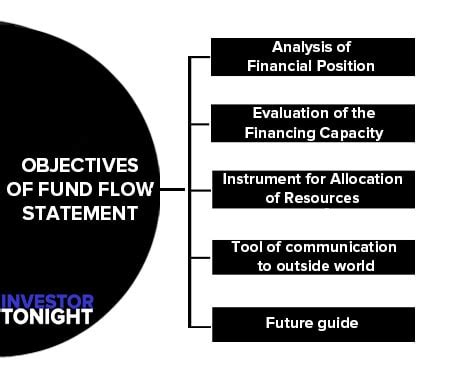

Investment Strategy of the American Balanced Fund

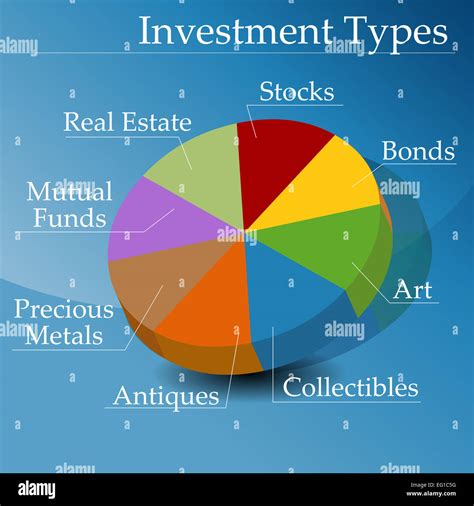

The American Balanced Fund's investment strategy is centered around providing a balanced portfolio of stocks and bonds. The fund invests in a mix of domestic and international stocks, as well as government and corporate bonds. The fund's investment team uses a combination of fundamental and quantitative research to select securities that meet the fund's investment objectives.

Stock Selection Process

The fund's investment team uses a rigorous stock selection process to identify high-quality stocks that have the potential for long-term growth. The team evaluates companies based on their financial health, management team, industry trends, and competitive position. The fund's stock portfolio is diversified across various sectors and industries, including technology, healthcare, financials, and consumer staples.

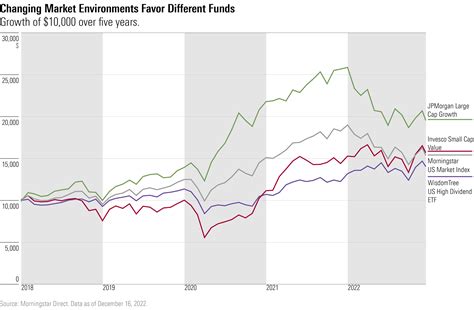

Performance of the American Balanced Fund

The American Balanced Fund has a strong track record of performance, with a history of delivering stable returns over the long-term. According to Morningstar, the fund has a 4-star rating and has outperformed its benchmark over the past 10 years. The fund's performance is attributed to its diversified portfolio, which has helped to reduce volatility and increase returns.

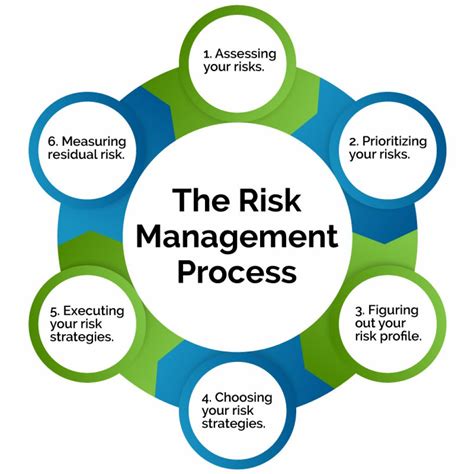

Risk Management

The American Balanced Fund's investment team uses a combination of risk management strategies to minimize losses and maximize returns. The team uses diversification to reduce exposure to individual stocks and bonds, and also employs hedging strategies to mitigate market risks.

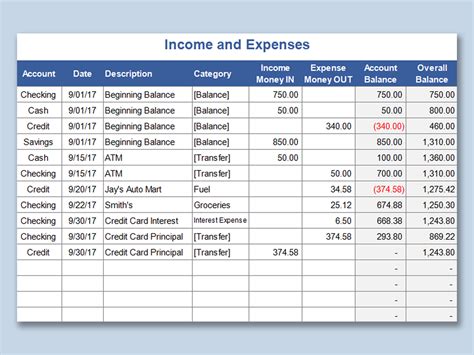

Fees and Expenses of the American Balanced Fund

The American Balanced Fund has a competitive fee structure, with a management fee of 0.58% and a total expense ratio of 0.63%. The fund also has a front-end load of 5.75%, which is waived for certain types of investments.

Tax Efficiency

The American Balanced Fund is designed to be tax-efficient, with a focus on minimizing tax liabilities. The fund's investment team uses tax-loss harvesting to offset gains and reduce tax liabilities.

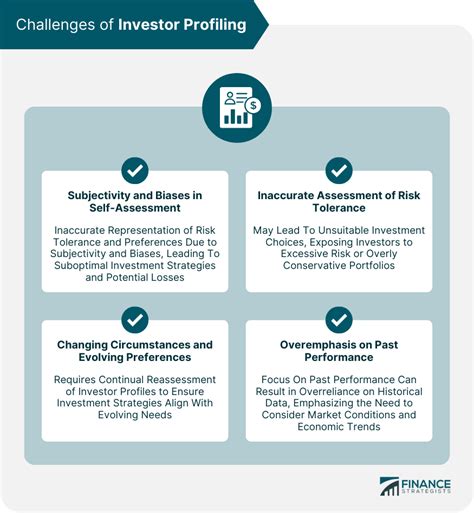

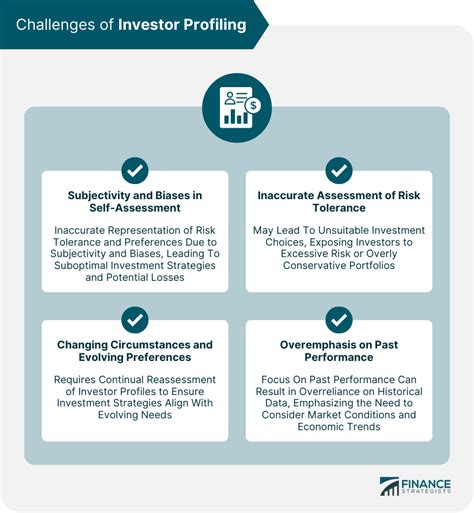

Who is the American Balanced Fund Suitable For?

The American Balanced Fund is suitable for investors who are looking for a stable source of income and capital growth. The fund is ideal for:

- Conservative investors who want to minimize risk

- Long-term investors who want to grow their wealth over time

- Income-seeking investors who want a regular stream of income

- Investors who want a diversified portfolio of stocks and bonds

How to Invest in the American Balanced Fund

Investing in the American Balanced Fund is easy and convenient. You can invest through various channels, including:

- American Funds website

- Financial advisors

- Brokerage firms

- Retirement accounts

American Balanced Fund Image Gallery

In conclusion, the American Balanced Fund is a great option for investors who are looking for a stable source of income and capital growth. With its diversified portfolio, competitive fee structure, and tax-efficient design, the fund is suitable for a wide range of investors. Whether you're a conservative investor or a long-term investor, the American Balanced Fund is definitely worth considering.

We hope this article has provided you with a comprehensive understanding of the American Balanced Fund. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with your friends and family who may be interested in investing in the American Balanced Fund.