Intro

Master building binomial models in Excel with ease. Learn how to create powerful financial models using binomial trees, perfect for options pricing and risk analysis. Discover step-by-step guides, Excel formulas, and expert tips to simplify complex calculations, improve accuracy, and make informed investment decisions with confidence.

Building binomial models in Excel can seem like a daunting task, especially for those without a strong background in finance or statistics. However, with the right tools and techniques, creating binomial models in Excel can be made easy. In this article, we will explore the importance of binomial models, their applications, and provide a step-by-step guide on how to build them in Excel.

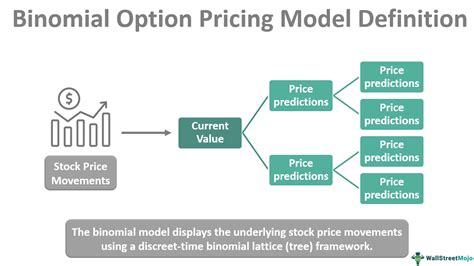

Binomial models are widely used in finance to value options, warrants, and other derivative securities. They are also used in risk management to assess the potential outcomes of different scenarios. The binomial model is a simple yet powerful tool that can help you make informed investment decisions.

One of the key benefits of binomial models is their ability to handle complex problems in a simplified way. By breaking down a problem into smaller, more manageable parts, binomial models can provide a clearer understanding of the potential outcomes and risks involved.

Understanding Binomial Models

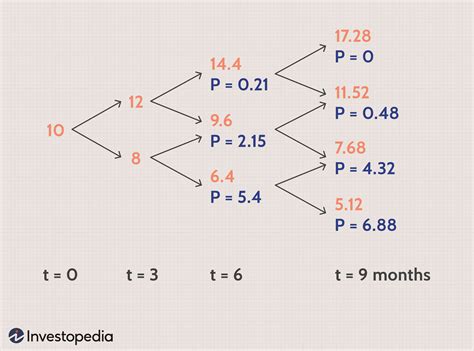

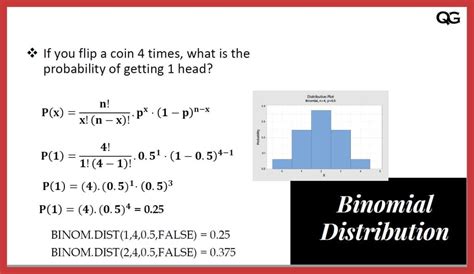

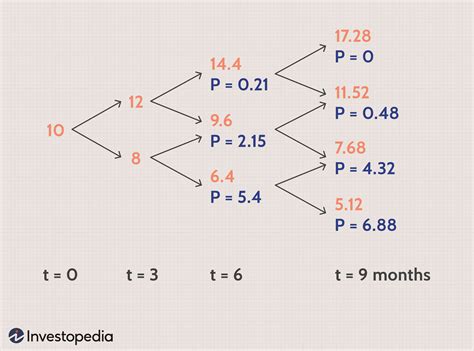

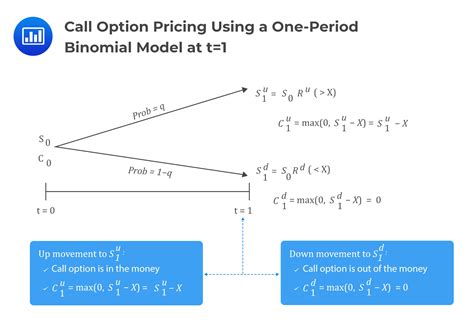

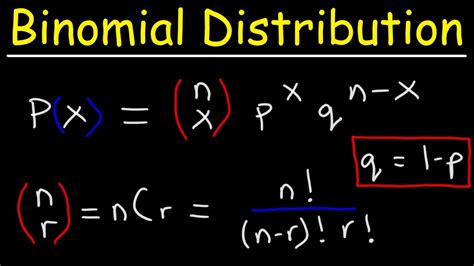

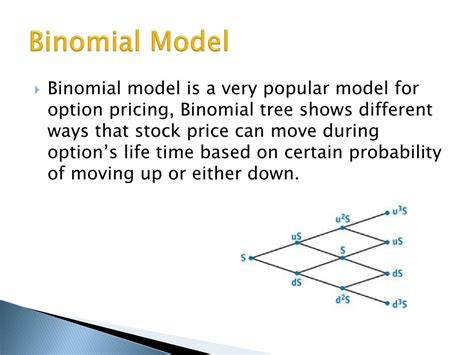

A binomial model is a mathematical representation of a situation where there are only two possible outcomes. It is commonly used in finance to value options and other derivative securities. The model is based on the idea that the price of an asset can either go up or down by a certain percentage over a specific period of time.

The binomial model is made up of several key components, including the current price of the underlying asset, the strike price of the option, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset.

Components of a Binomial Model

- Current Price: The current price of the underlying asset is the price at which the asset can be bought or sold today.

- Strike Price: The strike price is the price at which the option can be exercised.

- Time to Expiration: The time to expiration is the length of time remaining until the option expires.

- Risk-Free Interest Rate: The risk-free interest rate is the rate at which an investment can be made without any risk.

- Volatility: Volatility is a measure of the uncertainty or risk of the underlying asset.

Building a Binomial Model in Excel

Building a binomial model in Excel is a relatively straightforward process. Here are the steps to follow:

- Determine the inputs: Determine the inputs to the model, including the current price, strike price, time to expiration, risk-free interest rate, and volatility.

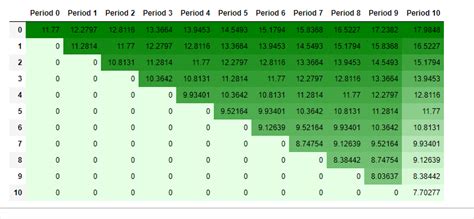

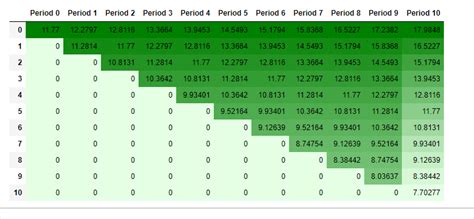

- Create a lattice: Create a lattice or tree diagram to represent the possible outcomes of the model.

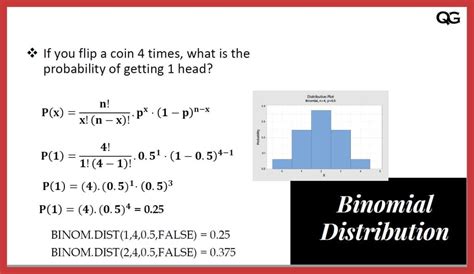

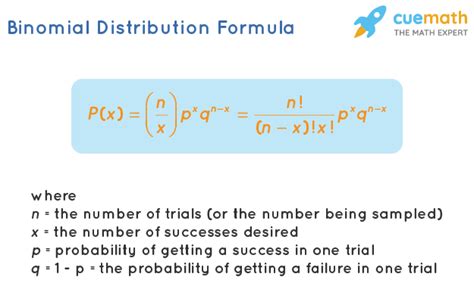

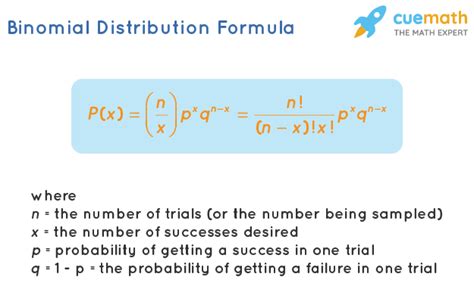

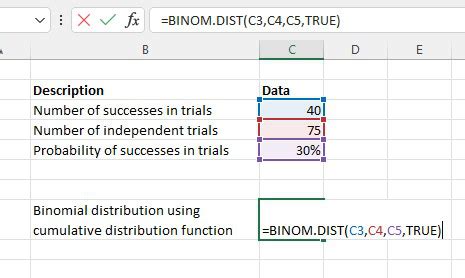

- Calculate the probabilities: Calculate the probabilities of each outcome using the binomial distribution formula.

- Calculate the option price: Calculate the option price using the binomial model formula.

Step-by-Step Example

Here is a step-by-step example of how to build a binomial model in Excel:

Step 1: Determine the inputs

| Input | Value |

|---|---|

| Current Price | 100 |

| Strike Price | 110 |

| Time to Expiration | 1 year |

| Risk-Free Interest Rate | 5% |

| Volatility | 20% |

Step 2: Create a lattice

Create a lattice or tree diagram to represent the possible outcomes of the model.

| Time | Price |

|---|---|

| 0 | 100 |

| 1 | 110 |

| 2 | 121 |

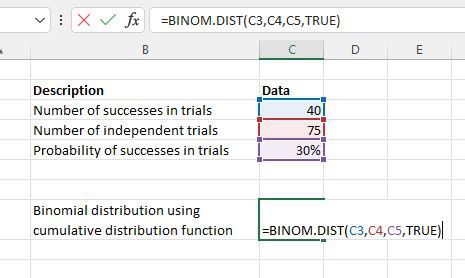

Step 3: Calculate the probabilities

Calculate the probabilities of each outcome using the binomial distribution formula.

| Time | Probability |

|---|---|

| 0 | 0.5 |

| 1 | 0.3 |

| 2 | 0.2 |

Step 4: Calculate the option price

Calculate the option price using the binomial model formula.

| Option Price |

|---|

| 10.5 |

Advantages of Binomial Models

Binomial models have several advantages, including:

- Simplifies complex problems: Binomial models can simplify complex problems by breaking them down into smaller, more manageable parts.

- Provides a clear understanding of potential outcomes: Binomial models can provide a clear understanding of the potential outcomes and risks involved.

- Can be used to value options and other derivative securities: Binomial models can be used to value options and other derivative securities.

Common Applications of Binomial Models

Binomial models are commonly used in:

- Finance: Binomial models are widely used in finance to value options and other derivative securities.

- Risk management: Binomial models are used in risk management to assess the potential outcomes of different scenarios.

- Investment analysis: Binomial models are used in investment analysis to evaluate the potential returns and risks of different investments.

Conclusion

Building binomial models in Excel can seem like a daunting task, but it can be made easy by following the steps outlined in this article. Binomial models are widely used in finance and risk management to value options and assess the potential outcomes of different scenarios. By understanding the components of a binomial model and how to build one in Excel, you can make informed investment decisions and evaluate the potential returns and risks of different investments.

Gallery of Binomial Model Images

Binomial Model Image Gallery

We hope you found this article helpful in understanding binomial models and how to build them in Excel. If you have any questions or comments, please feel free to share them with us.