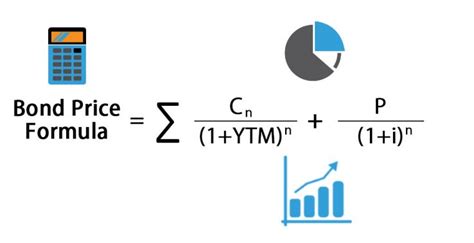

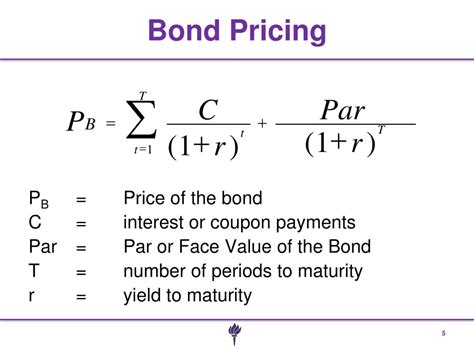

Bonds are a type of investment instrument where an investor loans money to an entity, typically a corporation or government, in exchange for regular interest payments and the eventual return of their principal investment. Calculating the price of a bond is crucial for investors to determine its value and make informed investment decisions. In this article, we will explore five ways to calculate bond price in Excel, a widely used spreadsheet software.

Understanding Bond Pricing

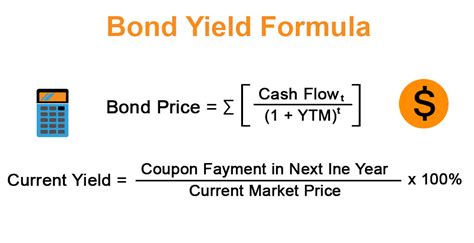

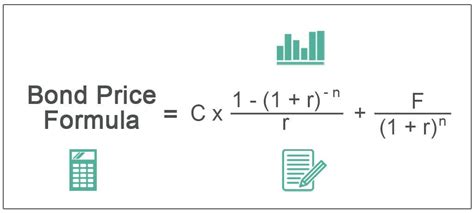

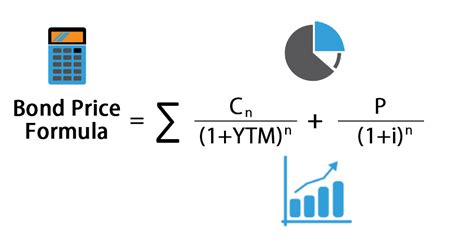

Before we dive into the calculations, it's essential to understand the factors that affect bond pricing. The price of a bond is influenced by several factors, including:

- Face value: The par value or face value of the bond, which is the amount the investor will receive at maturity.

- Coupon rate: The interest rate the bond pays periodically.

- Maturity: The length of time until the bond expires.

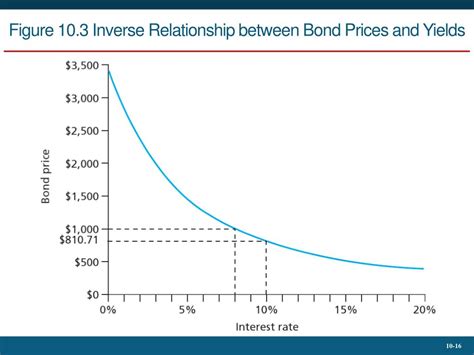

- Market interest rates: The prevailing interest rates in the market, which can affect the bond's price.

- Credit rating: The bond issuer's creditworthiness, which can impact the bond's price.

Method 1: Using the PV Function

The PV function in Excel can be used to calculate the present value of a bond, which is the current price of the bond. The syntax for the PV function is:

PV(rate, nper, pmt, [fv], [type])

Where:

- Rate is the interest rate per period.

- Nper is the number of periods.

- Pmt is the periodic payment.

- Fv is the future value or face value of the bond.

- Type is the type of payment (0 for payments at the end of the period, 1 for payments at the beginning of the period).

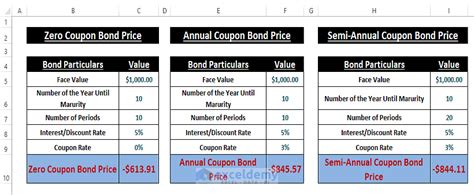

For example, suppose we want to calculate the price of a bond with a face value of $1,000, a coupon rate of 5%, a maturity of 10 years, and semi-annual payments. We can use the PV function as follows:

PV(0.05/2, 20, -25, 1000, 0)

This formula assumes that the interest rate is 5% per annum, the bond makes semi-annual payments, and the payments are made at the end of each period.

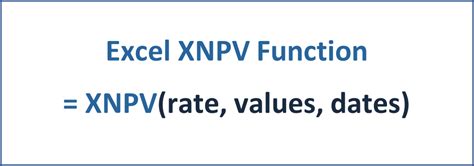

Method 2: Using the XNPV Function

The XNPV function in Excel can be used to calculate the present value of a series of cash flows that are not periodic. The syntax for the XNPV function is:

XNPV(rate, dates, cash flows)

Where:

- Rate is the interest rate per period.

- Dates is the range of dates for the cash flows.

- Cash flows is the range of cash flows.

For example, suppose we want to calculate the price of a bond with a face value of $1,000, a coupon rate of 5%, a maturity of 10 years, and semi-annual payments. We can use the XNPV function as follows:

XNPV(0.05/2, A1:A21, B1:B21)

This formula assumes that the interest rate is 5% per annum, the bond makes semi-annual payments, and the payments are made on the dates specified in column A.

Method 3: Using the YIELD Function

The YIELD function in Excel can be used to calculate the yield of a bond, which is the return on investment for the bondholder. The syntax for the YIELD function is:

YIELD(settlement, maturity, rate, pr, redemption, frequency, [basis])

Where:

- Settlement is the settlement date of the bond.

- Maturity is the maturity date of the bond.

- Rate is the interest rate per period.

- Pr is the price of the bond.

- Redemption is the redemption value of the bond.

- Frequency is the number of coupon payments per year.

- Basis is the day count basis (optional).

For example, suppose we want to calculate the yield of a bond with a face value of $1,000, a coupon rate of 5%, a maturity of 10 years, and semi-annual payments. We can use the YIELD function as follows:

YIELD(A1, A2, 0.05/2, 950, 1000, 2, 0)

This formula assumes that the settlement date is in cell A1, the maturity date is in cell A2, the interest rate is 5% per annum, the price of the bond is $950, the redemption value is $1,000, and the bond makes semi-annual payments.

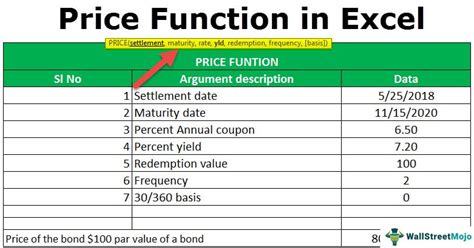

Method 4: Using the PRICE Function

The PRICE function in Excel can be used to calculate the price of a bond given the yield. The syntax for the PRICE function is:

PRICE(settlement, maturity, rate, yld, redemption, frequency, [basis])

Where:

- Settlement is the settlement date of the bond.

- Maturity is the maturity date of the bond.

- Rate is the interest rate per period.

- Yld is the yield of the bond.

- Redemption is the redemption value of the bond.

- Frequency is the number of coupon payments per year.

- Basis is the day count basis (optional).

For example, suppose we want to calculate the price of a bond with a face value of $1,000, a coupon rate of 5%, a maturity of 10 years, and semi-annual payments, given a yield of 4%. We can use the PRICE function as follows:

PRICE(A1, A2, 0.05/2, 0.04, 1000, 2, 0)

This formula assumes that the settlement date is in cell A1, the maturity date is in cell A2, the interest rate is 5% per annum, the yield is 4%, the redemption value is $1,000, and the bond makes semi-annual payments.

Method 5: Using a Bond Pricing Template

Another way to calculate bond price in Excel is to use a pre-built bond pricing template. A bond pricing template can be created using a combination of formulas and functions, such as the PV, XNPV, YIELD, and PRICE functions.

For example, we can create a bond pricing template that takes into account the face value, coupon rate, maturity, and market interest rates to calculate the bond price.

Gallery of Bond Price Calculations

Bond Price Calculation Gallery

In conclusion, calculating bond price in Excel can be done using various methods, including the PV, XNPV, YIELD, and PRICE functions, as well as using a bond pricing template. Each method has its own advantages and disadvantages, and the choice of method depends on the specific requirements of the bond and the investor's goals. By understanding the different methods of calculating bond price, investors can make more informed investment decisions and achieve their financial goals.