Intro

Discover if food stamp benefits are taxable. Learn about the tax implications of receiving SNAP benefits, and how they affect your income tax return. Understand the relationship between food stamps, income, and taxes, and find out if you owe taxes on your benefits. Get informed and maximize your benefits today!

Receiving food stamps benefits can be a lifesaver for individuals and families struggling to make ends meet. However, one common question that arises is whether food stamps benefits are taxable. In this article, we will delve into the details of whether you pay taxes on food stamps benefits and explore related topics, such as the impact of food stamps on your tax return and how to report food stamps on your taxes.

Are Food Stamps Benefits Taxable?

Fortunately, food stamps benefits are not taxable. According to the Internal Revenue Service (IRS), food stamps, also known as Supplemental Nutrition Assistance Program (SNAP) benefits, are not considered taxable income. This means that you do not have to report food stamps benefits on your tax return, and you will not be required to pay taxes on the benefits you receive.

Why Are Food Stamps Benefits Not Taxable?

Food stamps benefits are not taxable because they are considered a form of government assistance, rather than income. The purpose of food stamps is to help low-income individuals and families purchase food and other essential items, not to provide taxable income.

How Do Food Stamps Affect Your Tax Return?

As mentioned earlier, food stamps benefits are not taxable and do not need to be reported on your tax return. However, there are some situations where food stamps may affect your tax return:

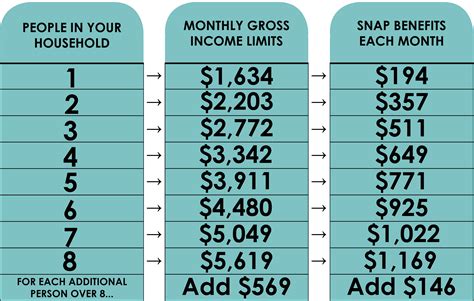

- If you receive food stamps benefits, you may be eligible for other tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit.

- If you have income from a job or other sources, you may still be required to file a tax return, even if you receive food stamps benefits.

- If you have dependents, such as children or elderly relatives, you may be able to claim them as dependents on your tax return, which could affect your tax liability.

How to Report Food Stamps on Your Taxes

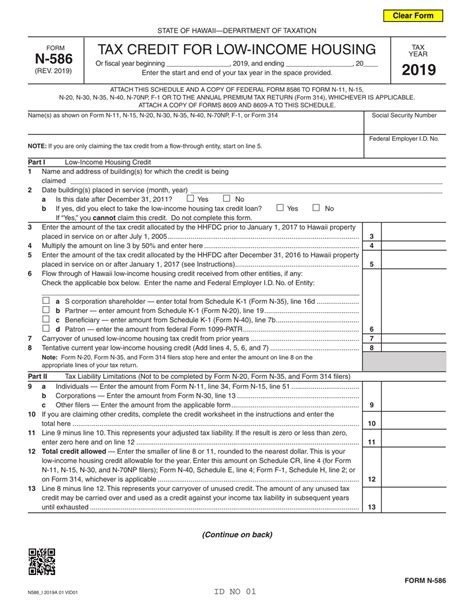

Since food stamps benefits are not taxable, you do not need to report them on your tax return. However, if you have income from other sources, you will need to report that income on your tax return.

To report income on your tax return, you will need to gather the following documents:

- W-2 forms from your employer(s)

- 1099 forms from any freelance or contract work

- Interest statements from banks and investments

- Dividend statements from stocks and investments

You will then need to complete Form 1040, which is the standard form for personal income tax returns. You may also need to complete additional forms, such as Schedule A for itemized deductions or Schedule C for business income.

Food Stamps and Tax Credits

As mentioned earlier, receiving food stamps benefits may make you eligible for other tax credits, such as the EITC or the Child Tax Credit. These tax credits can help reduce your tax liability and may even result in a refund.

To qualify for the EITC, you must meet certain income and eligibility requirements, which vary depending on your filing status and number of dependents. The Child Tax Credit is available to taxpayers who have dependents under the age of 17.

Other Tax Benefits for Low-Income Individuals

In addition to food stamps benefits, there are other tax benefits available to low-income individuals and families. Some of these benefits include:

- The Earned Income Tax Credit (EITC)

- The Child Tax Credit

- The Additional Child Tax Credit

- The Credit for Other Dependents

- The Savers Credit

These tax benefits can help reduce your tax liability and may even result in a refund. To qualify for these benefits, you will need to meet certain income and eligibility requirements, which vary depending on your filing status and number of dependents.

Food Stamps and Tax Planning

Receiving food stamps benefits can have implications for your tax planning. Since food stamps benefits are not taxable, you may want to consider other tax planning strategies to minimize your tax liability.

Some tax planning strategies to consider include:

- Claiming the EITC or Child Tax Credit, if eligible

- Itemizing deductions on Schedule A

- Claiming business expenses on Schedule C

- Contributing to a retirement account, such as a 401(k) or IRA

It's always a good idea to consult with a tax professional or financial advisor to determine the best tax planning strategy for your individual situation.

Gallery of Food Stamps and Taxes

Food Stamps and Taxes Image Gallery

Conclusion

Receiving food stamps benefits can be a lifesaver for individuals and families struggling to make ends meet. Fortunately, food stamps benefits are not taxable, and you do not have to report them on your tax return. However, it's essential to understand how food stamps may affect your tax return and to explore other tax benefits available to low-income individuals and families.

By understanding the relationship between food stamps and taxes, you can make informed decisions about your tax planning and take advantage of tax credits and benefits that may be available to you.

We hope this article has been informative and helpful. If you have any questions or concerns, please don't hesitate to reach out.