Intro

Discover the tax implications of food stamp benefits. Learn if you pay taxes on SNAP benefits, how benefits are reported, and whats considered taxable income. Understand the relationship between food stamps, income tax, and eligibility. Get informed about food stamp benefits and taxes to ensure youre in compliance.

Food stamp benefits, now known as the Supplemental Nutrition Assistance Program (SNAP), have been a vital lifeline for millions of low-income individuals and families in the United States. While these benefits provide essential support for food purchases, recipients often wonder if they are subject to taxes. In this article, we will delve into the taxation of food stamp benefits, exploring the rules and regulations surrounding this topic.

The Importance of Food Stamp Benefits

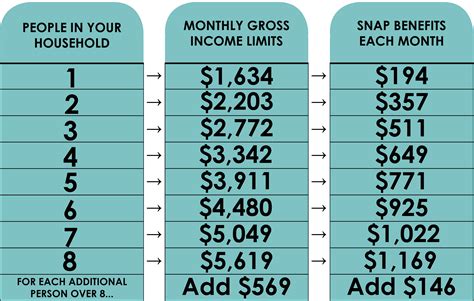

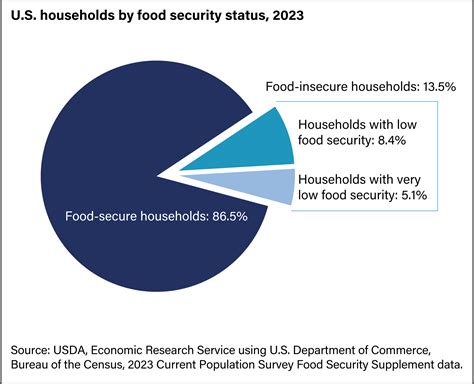

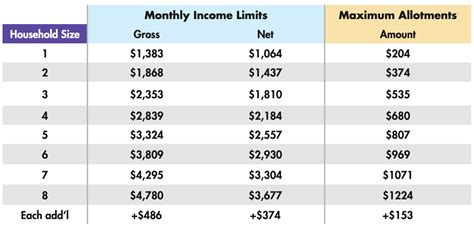

Food stamp benefits play a crucial role in helping low-income households access nutritious food. According to the United States Department of Agriculture (USDA), over 37 million people received SNAP benefits in 2020. These benefits not only alleviate food insecurity but also have a positive impact on local economies. By providing a financial safety net, food stamp benefits enable recipients to purchase food from authorized retailers, supporting local businesses and stimulating economic growth.

Taxation of Food Stamp Benefits: A Federal Perspective

At the federal level, food stamp benefits are generally not considered taxable income. According to the Internal Revenue Service (IRS), SNAP benefits are exempt from federal income tax. This means that recipients do not need to report these benefits as income on their tax returns. The IRS considers SNAP benefits as a form of government assistance, similar to other social welfare programs, and therefore does not subject them to taxation.

State-Level Taxation of Food Stamp Benefits

While federal law exempts food stamp benefits from taxation, state laws may differ. Some states may consider SNAP benefits as taxable income, although this is relatively rare. As of 2022, only a handful of states tax food stamp benefits, and these states typically have specific laws or regulations governing the taxation of these benefits.

For example, in the state of California, SNAP benefits are exempt from state income tax, following the federal exemption. However, in the state of New Jersey, SNAP benefits are considered taxable income, although the state provides a partial exemption for certain recipients.

Impact of Taxation on Food Stamp Benefits

The taxation of food stamp benefits can have significant implications for recipients. In states where SNAP benefits are taxable, recipients may be required to report these benefits as income on their state tax returns. This could result in a higher tax liability, potentially reducing the overall value of the benefits.

Moreover, taxation of food stamp benefits may also affect the eligibility of recipients for other government programs, such as Medicaid or housing assistance. By considering SNAP benefits as taxable income, states may inadvertently create a disincentive for recipients to participate in these programs, potentially exacerbating poverty and food insecurity.

Practical Implications for Food Stamp Recipients

For individuals receiving food stamp benefits, it is essential to understand the tax implications of these benefits in their state of residence. Recipients should be aware of the following:

- Check state laws: Recipients should verify whether their state considers SNAP benefits as taxable income.

- Report benefits: If state law requires it, recipients must report their SNAP benefits as income on their state tax returns.

- Seek assistance: Recipients can seek help from local tax authorities or non-profit organizations to understand the tax implications of their benefits.

Frequently Asked Questions

Q: Are food stamp benefits taxable at the federal level? A: No, food stamp benefits are exempt from federal income tax.

Q: Do states tax food stamp benefits? A: Some states may tax food stamp benefits, although this is relatively rare. Recipients should check their state laws for specific guidance.

Q: How do taxes on food stamp benefits affect recipients? A: Taxation of food stamp benefits can reduce the overall value of the benefits and potentially affect eligibility for other government programs.

Q: Can recipients seek assistance to understand tax implications? A: Yes, recipients can seek help from local tax authorities or non-profit organizations to understand the tax implications of their benefits.

Gallery of Food Insecurity and SNAP Benefits

Food Insecurity and SNAP Benefits Image Gallery

As the COVID-19 pandemic continues to impact communities worldwide, the importance of food stamp benefits has never been more apparent. By understanding the tax implications of these benefits, recipients can better navigate the complexities of the system and access the support they need. We encourage you to share your thoughts and experiences with food stamp benefits in the comments section below.