In today's fast-paced business world, maintaining accurate and up-to-date financial records is crucial for any organization. One essential tool for achieving this is the General Ledger (GL) reconciliation process. A well-structured GL reconciliation template in Excel can significantly simplify this task, saving time and reducing errors. In this article, we will explore the importance of GL reconciliation, its benefits, and provide a step-by-step guide on creating a GL reconciliation template in Excel.

Benefits of GL Reconciliation

GL reconciliation is the process of verifying the accuracy of the general ledger accounts by comparing them with external statements, such as bank statements or invoices. This process offers several benefits, including:

- Improved accuracy: Reconciling GL accounts ensures that the financial records are accurate, complete, and up-to-date.

- Enhanced internal controls: Regular reconciliation helps identify and correct errors, irregularities, or discrepancies in financial transactions.

- Better decision-making: Accurate financial data enables informed decision-making, reducing the risk of financial misstatements.

Creating a GL Reconciliation Template in Excel

To create a GL reconciliation template in Excel, follow these steps:

Step 1: Set up the Template Structure

Create a new Excel workbook and set up the following sheets:

- GL Reconciliation: This sheet will contain the reconciliation template.

- GL Accounts: This sheet will list the GL accounts to be reconciled.

- External Statements: This sheet will store the external statements, such as bank statements or invoices.

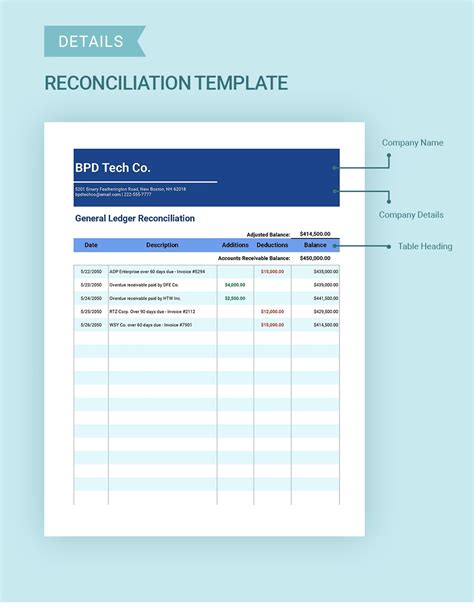

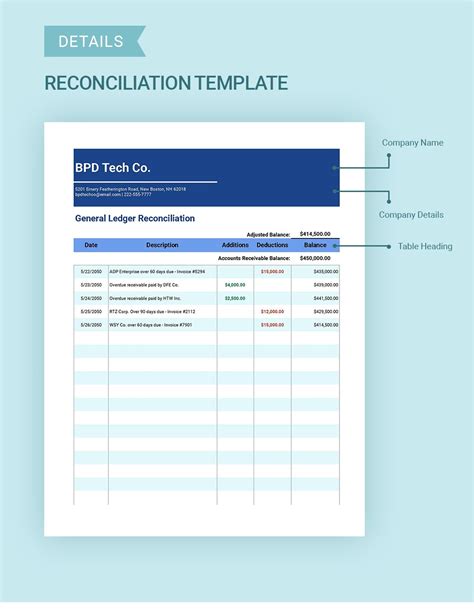

Step 2: Design the Reconciliation Template

In the GL Reconciliation sheet, create the following columns:

- Account Number: The GL account number.

- Account Name: The GL account name.

- External Statement Balance: The balance as per the external statement.

- GL Balance: The balance as per the GL account.

- Difference: The difference between the external statement balance and the GL balance.

Use formulas to calculate the difference and highlight any discrepancies.

Step 3: Link to GL Accounts and External Statements

Link the GL Reconciliation sheet to the GL Accounts and External Statements sheets using formulas or pivot tables. This will enable automatic updates and ensure data consistency.

Step 4: Format and Customize the Template

Format the template to make it visually appealing and easy to use. Customize the template to suit your organization's specific needs.

Best Practices for GL Reconciliation

To ensure effective GL reconciliation, follow these best practices:

- Regular Reconciliation: Reconcile GL accounts regularly, ideally monthly.

- Multiple Approval Levels: Implement multiple approval levels to ensure accuracy and prevent errors.

- Documentation: Maintain detailed documentation of the reconciliation process and any discrepancies.

Common Challenges in GL Reconciliation

GL reconciliation can be challenging, especially when dealing with:

- Large Volumes of Data: Managing large volumes of data can be time-consuming and prone to errors.

- Complex Transactions: Complex transactions, such as multi-currency transactions, can be difficult to reconcile.

GL Reconciliation Tools and Software

Several tools and software are available to facilitate GL reconciliation, including:

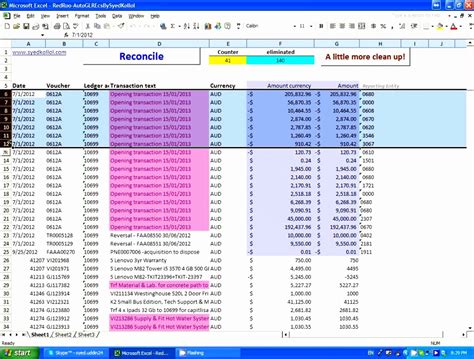

- Excel Add-ins: Excel add-ins, such as AutoReconcile, can automate the reconciliation process.

- Accounting Software: Accounting software, such as QuickBooks or Xero, often includes built-in reconciliation features.

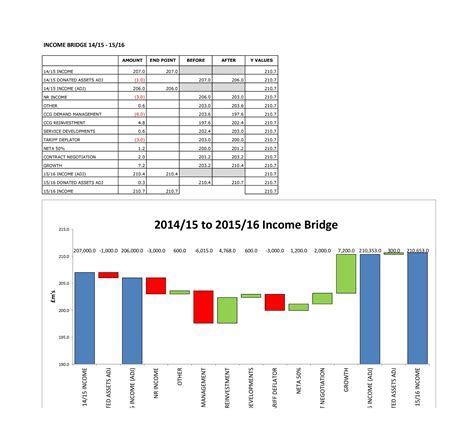

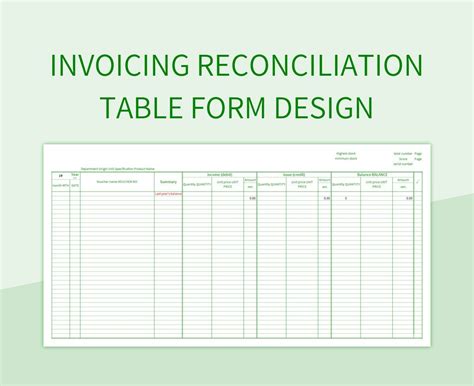

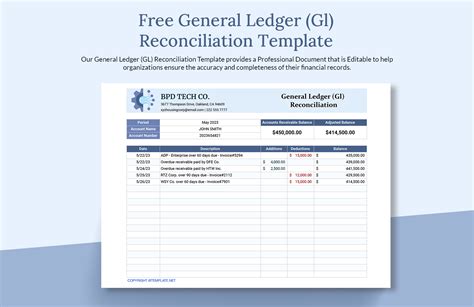

Gallery of GL Reconciliation Templates

GL Reconciliation Template Gallery

Conclusion

GL reconciliation is a critical process that ensures the accuracy and integrity of financial records. By creating a well-structured GL reconciliation template in Excel, organizations can simplify this process, reduce errors, and improve financial decision-making. By following the steps outlined in this article, you can create an effective GL reconciliation template and take the first step towards maintaining accurate and reliable financial records.

We hope this article has provided you with valuable insights into GL reconciliation and how to create a GL reconciliation template in Excel. If you have any further questions or would like to share your experiences, please feel free to comment below.