Intro

Learn how to calculate CD interest in Excel with these 4 easy methods. Discover formulas and functions to compute compound interest, APY, and maturity value. Boost your financial analysis skills with Excel tips and tricks for CD interest calculations, including PMT, IPMT, and XNPV functions.

Calculating CD interest in Excel can be a straightforward process, allowing you to easily understand and manage your savings. Whether you're an individual looking to save for the future or a financial professional managing multiple accounts, Excel provides the tools you need to compute CD interest with precision.

In this article, we will delve into four methods to calculate CD interest in Excel. Each method is designed to cater to different needs and preferences, ensuring that you can find the approach that best suits your requirements.

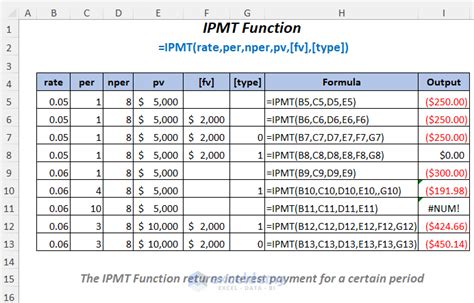

Method 1: Using the IPMT Function

The IPMT function in Excel is a powerful tool for calculating the interest portion of a loan or investment payment. To use this function for CD interest calculation, you need to know the principal amount, the annual interest rate, and the time period in years.

Here's the syntax for the IPMT function:

IPMT(rate, per, nper, pv, [fv], [type])

rateis the annual interest rate.peris the payment period for which you want to calculate the interest.nperis the total number of payment periods.pvis the principal amount.[fv]is the future value, which is optional and defaults to 0 if not provided.[type]is the payment type, which is also optional and defaults to 0 if not provided, indicating payments are due at the end of the period.

For a CD, which is essentially a time deposit offered by banks with a fixed interest rate and maturity date, you would typically want to calculate the interest accrued over a specific period.

Example

Suppose you have a CD with a principal amount of $10,000, an annual interest rate of 2%, and a term of 5 years. To calculate the interest for the first year, you would use the IPMT function as follows:

=IPMT(0.02, 1, 5, 10000)

This formula calculates the interest portion of the first payment (or in this case, the interest accrued over the first year).

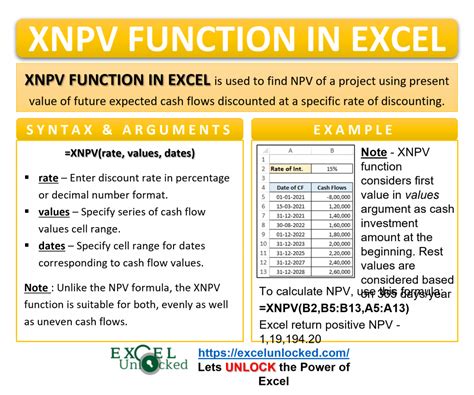

Method 2: Using the XNPV Function

The XNPV function in Excel calculates the present value of a series of cash flows that occur at irregular intervals. While not as directly applicable to simple CD interest calculations as the IPMT function, it can be useful for more complex scenarios where the interest is compounded at irregular intervals.

The syntax for the XNPV function is:

XNPV(rate, dates, cash flows)

rateis the annual interest rate.datesis a series of dates representing when the cash flows occur.cash flowsare the amounts of the cash flows.

This function can be adapted for CD interest by considering the cash flows as the interest payments.

Example

Calculating the present value of a series of annual interest payments from a CD using the XNPV function involves setting up a series of cash flows for each year. For a CD with a principal of $10,000 and an annual interest rate of 2%, compounded annually for 5 years, you would first need to calculate the annual interest payments using the formula for simple interest (Principal * Rate * Time) or use the IPMT function as described earlier. Then, you would use the XNPV function to calculate the present value of these cash flows.

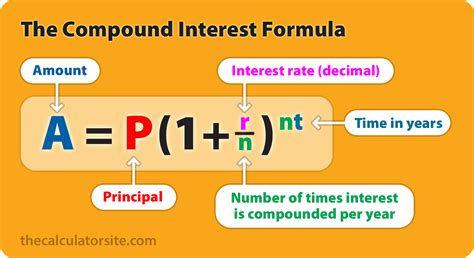

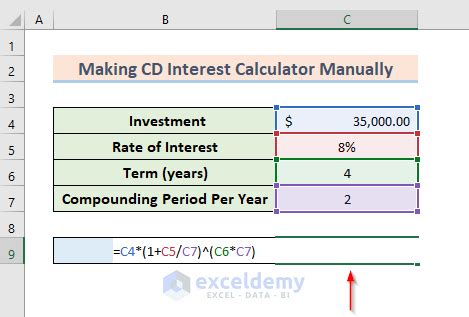

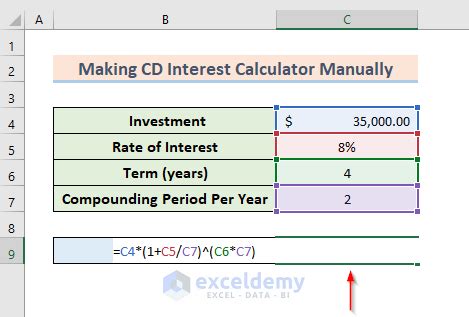

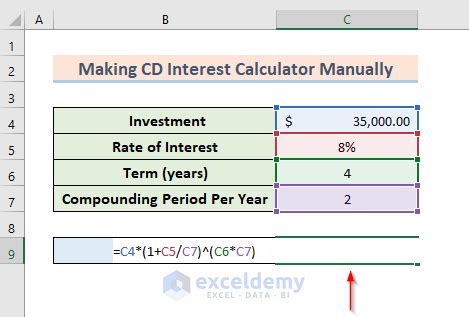

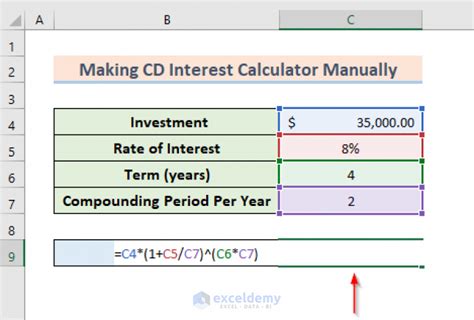

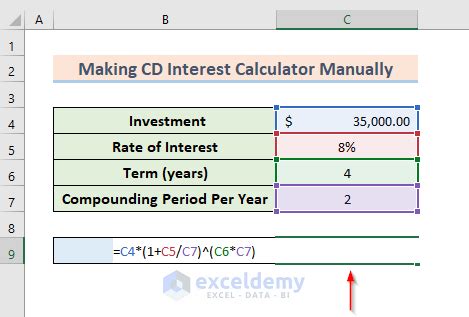

Method 3: Using a Formula for Compound Interest

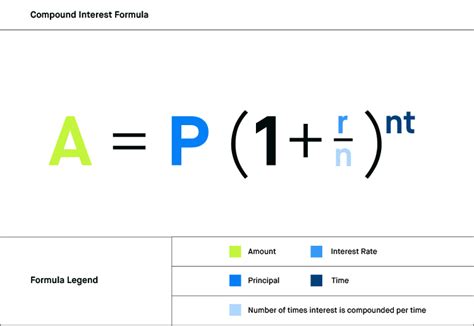

The formula for compound interest is:

A = P(1 + r/n)^(nt)

Ais the amount of money accumulated after n years, including interest.Pis the principal amount (the initial amount of money).ris the annual interest rate (in decimal).nis the number of times that interest is compounded per year.tis the time the money is invested for in years.

This formula can be adapted to calculate CD interest by solving for the interest portion (A - P).

Example

Using the compound interest formula to calculate the interest on a $10,000 CD with an annual interest rate of 2%, compounded annually for 5 years:

=A2*(1+B2/C2)^(C2*D2)-A2

Assuming the principal is in cell A2, the annual interest rate in cell B2 (as a decimal), the compounding frequency in cell C2, and the time in years in cell D2.

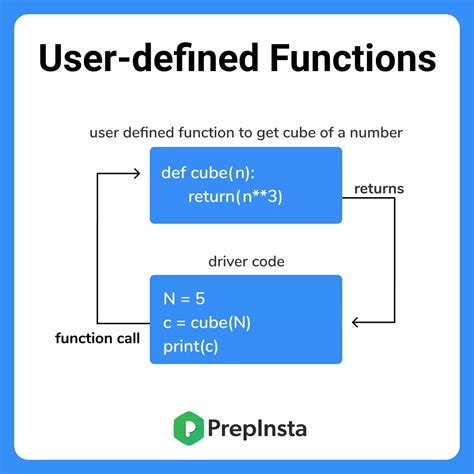

Method 4: Using a User-Defined Function (UDF)

Creating a User-Defined Function (UDF) in VBA (Visual Basic for Applications) can offer a customized approach to calculating CD interest. A UDF allows you to define your own function that can be used in Excel just like any other function.

Here's a simple example of how you might create a UDF to calculate CD interest:

Function CDInterest(principal As Double, rate As Double, years As Integer, frequency As Integer) As Double

CDInterest = principal * (1 + rate / frequency) ^ (frequency * years) - principal

End Function

This function calculates the total interest earned on a CD, taking into account the principal amount, annual interest rate, term in years, and the compounding frequency per year.

Example

To use the UDF in your Excel sheet, you would simply call the function with the required parameters:

=CDInterest(10000, 0.02, 5, 1)

This calculates the total interest on a $10,000 CD with an annual interest rate of 2%, compounded annually for 5 years.

CD Interest Calculation Image Gallery

Calculating CD interest in Excel can be accomplished through various methods, each suited to different scenarios and user preferences. Whether you opt for the IPMT function for straightforward calculations, the compound interest formula for a more nuanced approach, or create a customized User-Defined Function, Excel provides the flexibility and power needed to accurately determine CD interest. By understanding and applying these methods, individuals and financial professionals alike can better manage and understand their savings and investments.